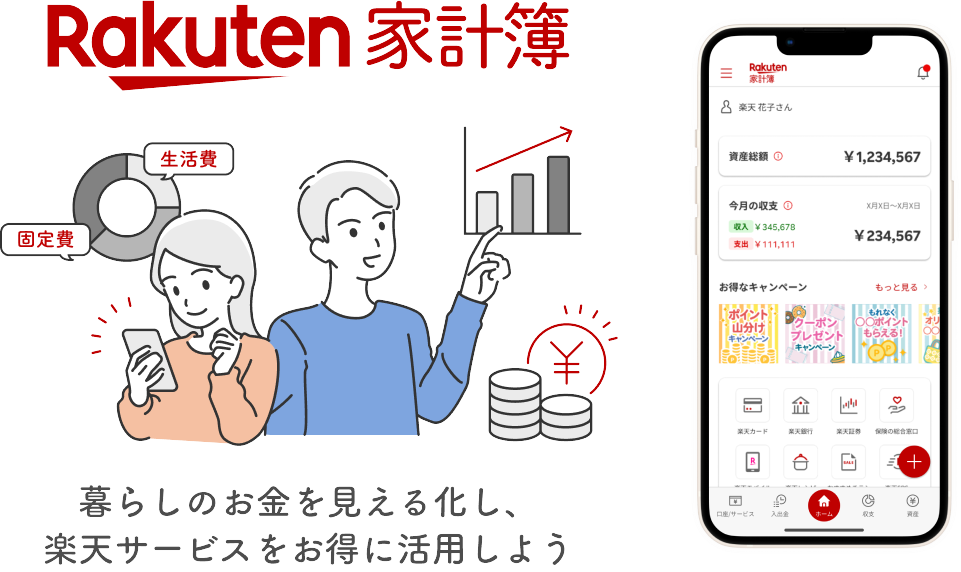

Rakuten, one of Japan’s leading IT companies, has suddenly released a household accounting application.

Rakuten is the biggest competitor to Amazon in Japanese e-commerce and has built up a large service sphere, from financial services such as securities and banking to travel.

It is linked to credit cards, bank accounts and securities accounts, enabling centralised management of income and assets.

The service is first available on iOS and is currently under development for Android.

It can be linked to banks, credit cards, e-commerce and other services that Rakuten has already developed and gained a large customer base, and it can be linked to bank accounts outside Rakuten and the services of other companies over 1,000 services.

The state of household account bookkeeping apps in Japan

Two major apps exist.

Zaim

Zaim’s key point is that it can link bank accounts and multiple credit cards and automatically records statements, saving you the time and effort of manually entering each one, so you can keep track of your finances without strain.

Another great attraction of the system is that receipts can be read with a smartphone and automatically recorded. Shop names and amounts can also be recorded in great detail.

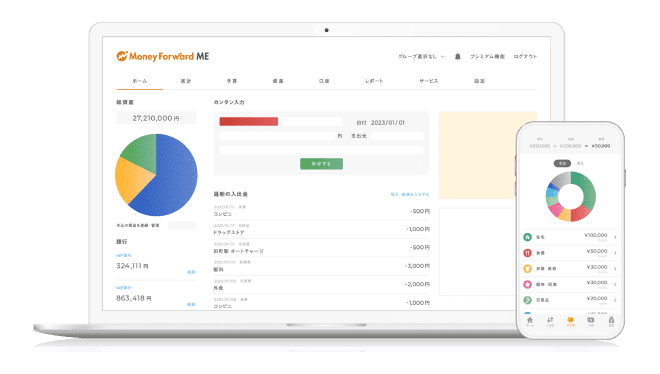

Money Forward ME

Money Forward ME is a household accounting apps for individuals provided by Money Forward, which also offers an accounting system for corporations.

Based on bank deposits and withdrawals and credit card history, the system automatically categorises them into categories such as food and utility costs and creates a household account book.

Furthermore, there is a function that displays bank deposits and withdrawals and credit card usage history, as well as graphs that show monthly income and expenditure at a glance, allowing the user to visualise improvements in monthly income and expenditure.

What will be the future of household budgeting apps?

Household accounting apps exist outside of Zaim and Money Forward ME, and market conditions make it difficult for new players to emerge. It is a bit of a surprise that Rakuten has struck into this market, but it may be a logical strategy for them to release a household account bookkeeping app, as they have already built the Rakuten Economic Bloc.

There is no denying that the Japanese tend to save rather than invest and that the national character has a tendency to like saving. Household budgeting apps may play an important role in such countries.

In addition, In these days of a weak yen and high prices, these apps may be even more helpful.

But what would be most desirable is for Japan’s economy to improve…